sacramento county tax rate 2021

The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. The current total local sales tax rate in Sacramento County CA is 7750.

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

California has a 6 sales tax and Sacramento County collects an additional 025 so the minimum sales tax rate in Sacramento County is 625 not including any city or special district taxes.

. T he tax rate is. 31 2021 additional collection costs and monthly penalties at the rate of 15 percent will be added to the base tax. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

The assessment roll reflects the total gross assessed value of locally assessed real business and personal property in Sacramento County as of January 1 2021. The California state sales tax rate is currently 6. The Sacramento County sales tax rate is 025.

This is the total of state and county sales tax rates. Sellers are required to report and pay the applicable district taxes for their taxable. The 2018 United States Supreme Court decision in South.

The California sales tax rate is currently. Who are the Discount Realtors in Elizabeth. Sacramento CA Sales Tax Rate.

As of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. The minimum combined 2022 sales tax rate for Sacramento County California is 775.

July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over last year. What is the sales tax rate in Sacramento County. Tax Collection and Licensing.

Tax Collection Specialists are available for customer assistance via telephone at 916 874-6622 Monday Friday from 900am to 400pm or via email at TaxSecuredsaccountygov. Box 8207 Columbia SC 29202-8207. 803-252-7255 800-922-6081 Fax 803-252-0379.

For tax rates in other cities see. Those district tax rates range from 010 to 100. If a tax bill remains unpaid after Oct.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The sales tax jurisdiction name is Sacramento Tmd Zone 1 which may refer to a local government division. The California state sales tax rate is currently 6.

The total sales tax rate in any given location can be broken down into state county city and special district rates. How much is county transfer tax in Sacramento County. 2021-2022 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918.

The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143. Did South Dakota v.

The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The latest sales tax rate for Sacramento CA.

The December 2020 total local sales tax rate was also 8750. For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. Some areas may have more than one district tax in effect.

The December 2020 total local sales tax rate was also 7750. Sacramento county 2019-2020 compilation of tax rates by code area code area 03-017 code area 03-018 code area 03-019 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00232 los rios coll gob 00232 los rios coll gob 00232 sacto unified gob 01139 sacto unified gob 01139 sacto unified gob 01139. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page.

55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer. This is the total of state and county sales tax rates. 1788 rows California City County Sales Use Tax Rates effective April 1 2022.

Cody Tromler November 24 2021 March 17 2022. The Sacramento County sales tax rate is 025. This is the total of state county and city sales tax rates.

What is the Sacramento County tax rate. You can print a 875 sales tax table here. 1919 Thurmond Mall Columbia SC 29201.

View the E-Prop-Tax page for more information. Payments may be made by mail or in person at the County Tax Collectors Office located at 700 H Street Room 1710 Sacramento CA 95814 between the hours of 8 am. The current total local sales tax rate in Sacramento CA is 8750.

Historical Tax Rates in California Cities Counties. The statewide tax rate is 725. Sacramento County California sales tax rate details The minimum combined 2021 sales tax rate for Sacramento County California is 775.

2020 rates included for use while preparing your income tax deduction. The Sacramento County Sales Tax is collected by the merchant on all. And 5 pm.

Property information and maps are available for review using the Parcel Viewer Application. What is the sales tax rate in Sacramento California. 2021 March 17 2022.

The Sacramento sales tax rate is. By Check Payable to. The County sales tax rate is.

How much is the documentary transfer tax. Equalized Rolls - District Valuation Report. Thursday July 01 2021.

This rate includes any state county city and local sales taxes. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

The minimum combined 2022 sales tax rate for Sacramento California is. Payments may be made as follows.

New Jersey Nj Tax Rate H R Block

Property Taxes Department Of Tax And Collections County Of Santa Clara

Housing In Infrastructure Bill Real Estate Agent And Sales In Pa Anthony Didonato Broomall Media Delaware Coun Infrastructure Sale House Real Estate News

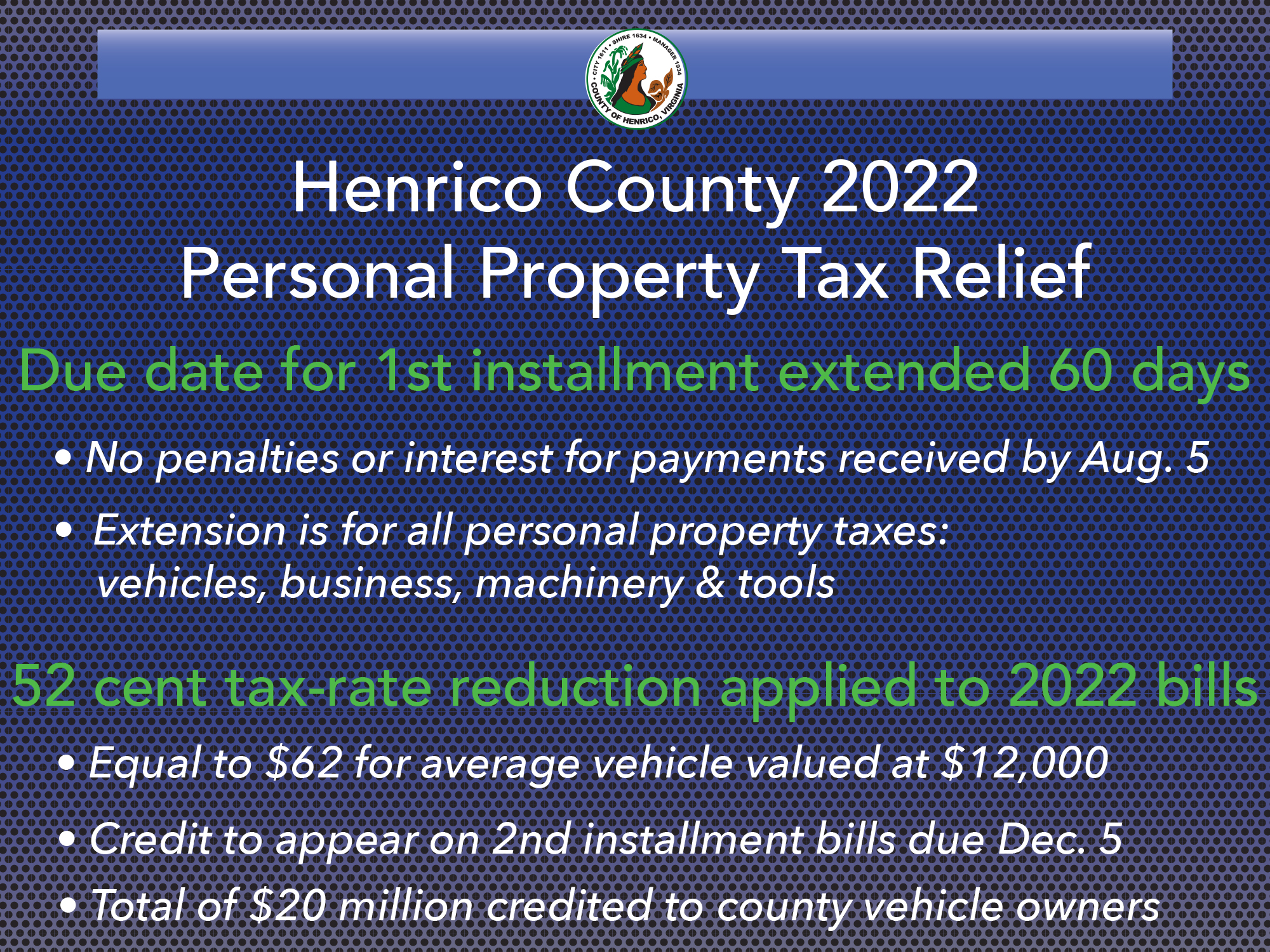

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Missouri Income Tax Rate And Brackets H R Block

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

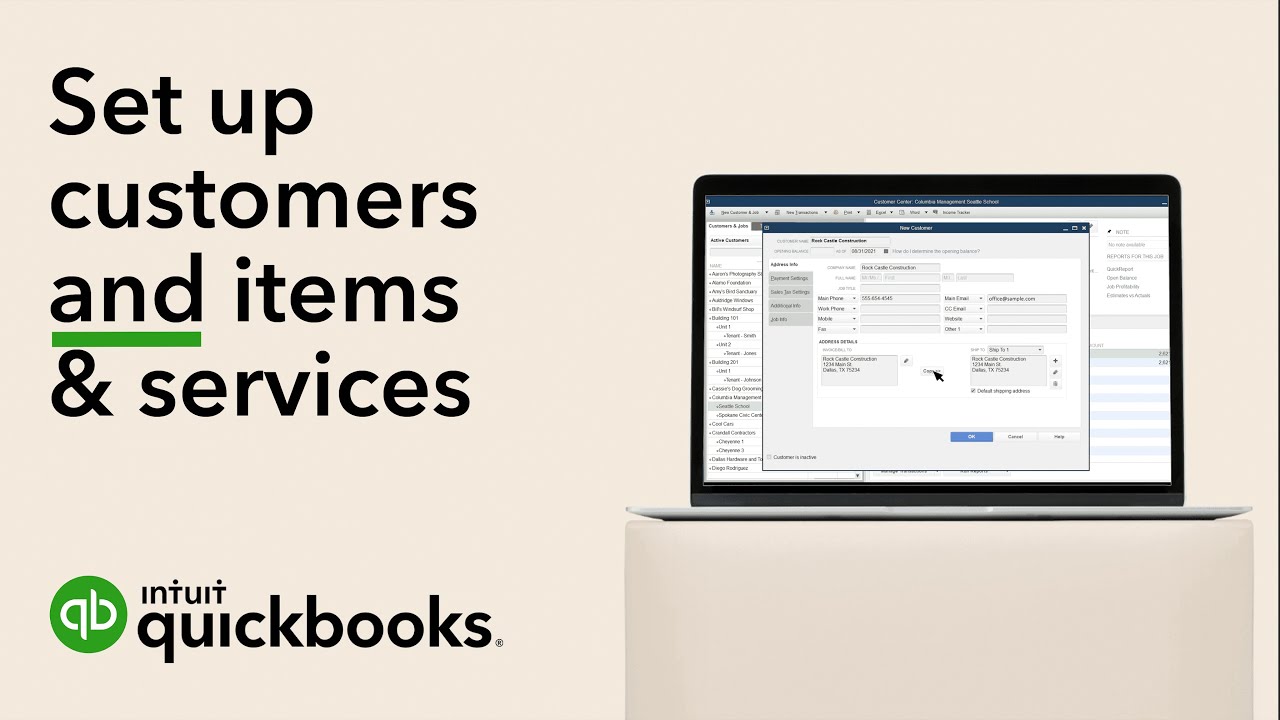

How To Set Up Sales Tax In Quickbooks Desktop Youtube

Women Make 3 Key Investing Mistakes Investing Start Investing Bond Funds

Secured Property Taxes Treasurer Tax Collector

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Cryptocurrency Taxes What To Know For 2021 Money

What Are California S Income Tax Brackets Rjs Law Tax Attorney

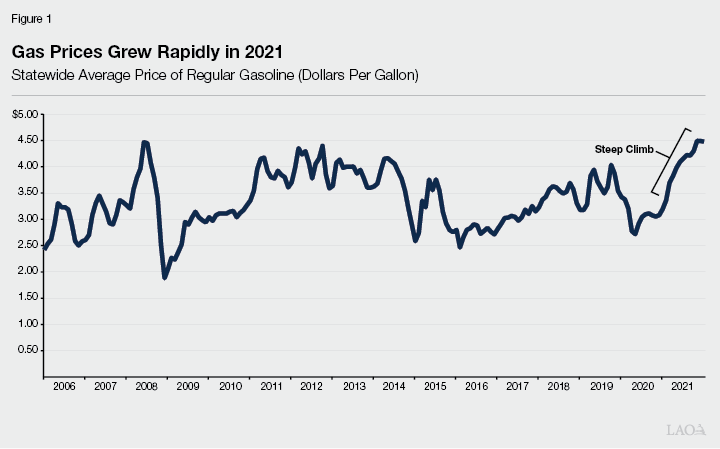

The 2022 23 Budget Fuel Tax Rates