south dakota sales tax rate changes 2021

Ad Keep up with changing tax laws. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

Historical South Dakota Tax Policy Information Ballotpedia

The South Dakota Department of Revenue administers these taxes.

. Look up 2021 South Dakota sales tax rates in an easy to navigate table listed by county and city. Start Your Tax Filing Today. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

If you need access to a regularly-updated. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2.

Beginning January 1 2022 the town of Lane is implementing a new municipal tax rate from 0 percent general sales and use tax rate to 2. Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. Tuesday June 1 2021.

Average Sales Tax With Local. New rates were last updated on 712021. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

Ad Keep up with changing tax laws. December 2021 78 changes Over the past year there have been 1096 local sales tax rate changes in states cities and counties across the United States. South Dakota Department of Revenue Municipal Tax Guide July 2021 3 Glossary of Terms South Dakota law SDCL 10-52 and 10-52A allows municipalities to impose a municipal sales.

Ad Easy online preparation software. If you need access to a regularly-updated database of sales tax rates. The South Dakota sales tax and use tax rates are 45.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. 2022 South Dakota state sales tax. Place Old Rate New Rate.

Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. Look up 2021 sales tax rates for Bethlehem South Dakota and surrounding areas. See Whats Been Adjusted For Income Tax Brackets In 2022 vs.

Get the Avalara Tax Changes Midyear Update today. Exact tax amount may vary for different items. The base state sales tax rate in South Dakota is 45.

South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. Your 2021 Tax Bracket To See Whats Been Adjusted. Get the Avalara Tax Changes Midyear Update today.

They may also impose a 1 municipal gross. The Richland sales tax rate is. New Municipal Tax Changes Effective July 1 2021.

We provide sales tax rate databases for. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. Municipalities may impose a general municipal sales tax rate of up to 2.

South Dakota SD Sales Tax Rate Changes. Simplify South Dakota sales tax compliance. 2022 List of South Dakota Local Sales Tax Rates.

Raised from 45 to 65. The Kyle South Dakota sales tax rate of 45 applies in the zip code 57752. Easily manage tax compliance for the most complex states product types and scenarios.

Easily manage tax compliance for the most complex states product types and scenarios. Sales tax rates are subject to. Raised from 45 to 65.

Free sales tax calculator tool to estimate total amounts. Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. South Dakota Department of Revenue Municipal Tax Guide January 2021 3 Glossary of Terms South Dakota law SDCL 10-52 and 10-52A allows municipalities to impose a municipal sales.

12-01-2021 1 minute read. Ad Compare Your 2022 Tax Bracket vs. Stacey Anderson Marketing Communications Specialist.

Find your South Dakota. This page allows you to.

2021 State Corporate Tax Rates And Brackets Tax Foundation

New Municipal Tax Changes Effective January 1 2022 South Dakota Department Of Revenue

Sales Tax Collection Increase In 2020 Gardnernews Com

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

State By State Guide To Economic Nexus Laws

South Dakota Income Tax Calculator Smartasset

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

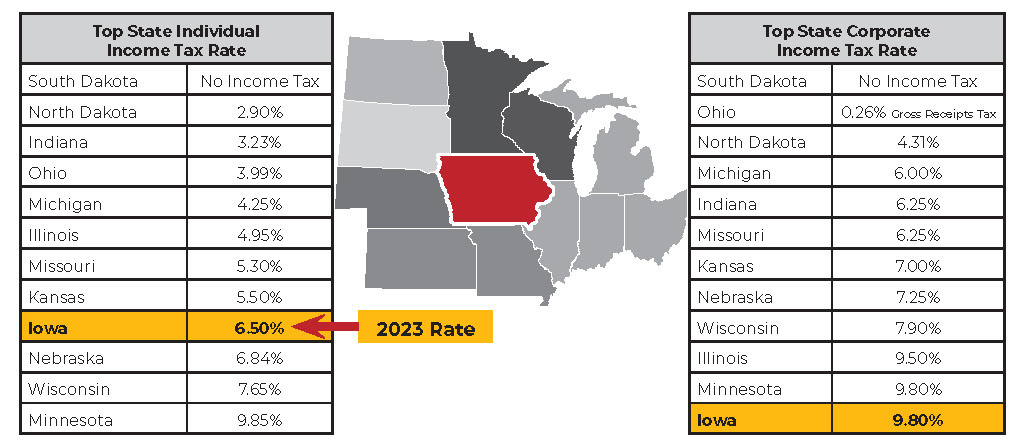

Iowa Still Has High Income Tax Rates Iowans For Tax Relief

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

How South Dakota Became A Haven For Dirty Money The Atlantic

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

South Dakota Turned Itself Into A Tax Haven But Why

State Sales Tax Rates 2022 Avalara

The Great American Tax Haven Why The Super Rich Love South Dakota Tax Havens The Guardian